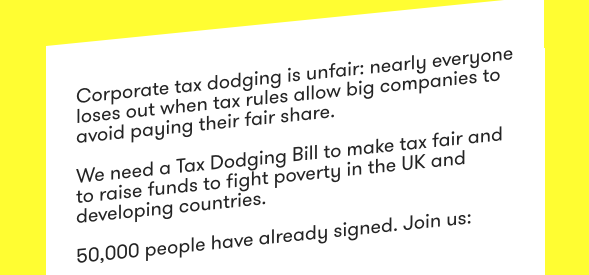

"Tax Dodging Bill Campaign"

http://www.taxdodgingbill.org.uk

http://www.taxdodgingbill.org.uk

A couple of weeks ago I signed an online petition complete with a message to known local parliamentary candidates enquiring as to their attitude on this topic. The message went to 3 candidates, (Conservative, Labour and LibDem). To date I have only received one reply, namely from Labour candidate Paul Harvey. It reads as follows:

"Dear Martin,

Thank you for your email. This is such a live subject that has real importance because it strikes at the heart of what kind of society do we want to be.

When HMRC are chasing small businesses and people on lower incomes as vigorously as they do, but let major companies and powerful individuals off without investigation and prosecution there is something fundamentally wrong with the system. That is unjust and needs challenging. Some of the revelations of recent weeks have been shocking and we need determined action on this.

I back the measures you spoke of in your email, but I would go further and I also support my national party’s view that there should be a root and branch review of HMRCs practices and in cases of blatant and flagrant tax avoidance, like in the HSBC case, penalties need to be hard. This is a matter not simply of closing loops holes, but it is a matter of the rule of law.

This a moral issue, it is about the kind of society we want to live in. It is an economic issue because yet again it shows that for the privileged few and the big corporations they are allowed to get away with avoiding their responsibilities to our society while the rest of us carry the burden. There is so much to this issue that needs exposing, and I agree transparency is crucial.

I support, like the Labour Party has made clear, measures that affect real change in the way tax avoidance is stamped out, especially amongst those who think they are beyond the reach of our laws.

This is not about being anti-business, in-fact nothing could be further from the truth, this about supporting the best practices in all businesses and in our society – this really is about fairness and equality.

I hope that answers your question, but don’t hesitate to contact me to discuss this further if you would like - 07968 941009.

Best regards

Paul.”

Thank you for your email. This is such a live subject that has real importance because it strikes at the heart of what kind of society do we want to be.

When HMRC are chasing small businesses and people on lower incomes as vigorously as they do, but let major companies and powerful individuals off without investigation and prosecution there is something fundamentally wrong with the system. That is unjust and needs challenging. Some of the revelations of recent weeks have been shocking and we need determined action on this.

I back the measures you spoke of in your email, but I would go further and I also support my national party’s view that there should be a root and branch review of HMRCs practices and in cases of blatant and flagrant tax avoidance, like in the HSBC case, penalties need to be hard. This is a matter not simply of closing loops holes, but it is a matter of the rule of law.

This a moral issue, it is about the kind of society we want to live in. It is an economic issue because yet again it shows that for the privileged few and the big corporations they are allowed to get away with avoiding their responsibilities to our society while the rest of us carry the burden. There is so much to this issue that needs exposing, and I agree transparency is crucial.

I support, like the Labour Party has made clear, measures that affect real change in the way tax avoidance is stamped out, especially amongst those who think they are beyond the reach of our laws.

This is not about being anti-business, in-fact nothing could be further from the truth, this about supporting the best practices in all businesses and in our society – this really is about fairness and equality.

I hope that answers your question, but don’t hesitate to contact me to discuss this further if you would like - 07968 941009.

Best regards

Paul.”

If you wish to comment and don't have a "Gmail” account, just select "Name/URL" to make your point.

No comments:

Post a Comment